# Define model's specification

model.spec <- list()

model.spec$B <- matrix(

list(

"b1", 1, 0, 0,

"b2", 0, 1, 0,

"b3", 0, 0, 1,

"b4", 0, 0, 0

), 4, 4)

model.spec$Z <- matrix(

list(0), nrow(CPI_ts), 4)

model.spec$Z[, 1] <- rownames(CPI_ts)

model.spec$Q <- "diagonal and equal"

model.spec$R <- "diagonal and unequal"

model.spec$A <- "zero"

# Estimate using the EM Algorithm

model.em <- MARSS(

CPI_ts,

model = model.spec,

inits = list(x0 = 0),

silent = TRUE

)14 Dynamic Factor Model

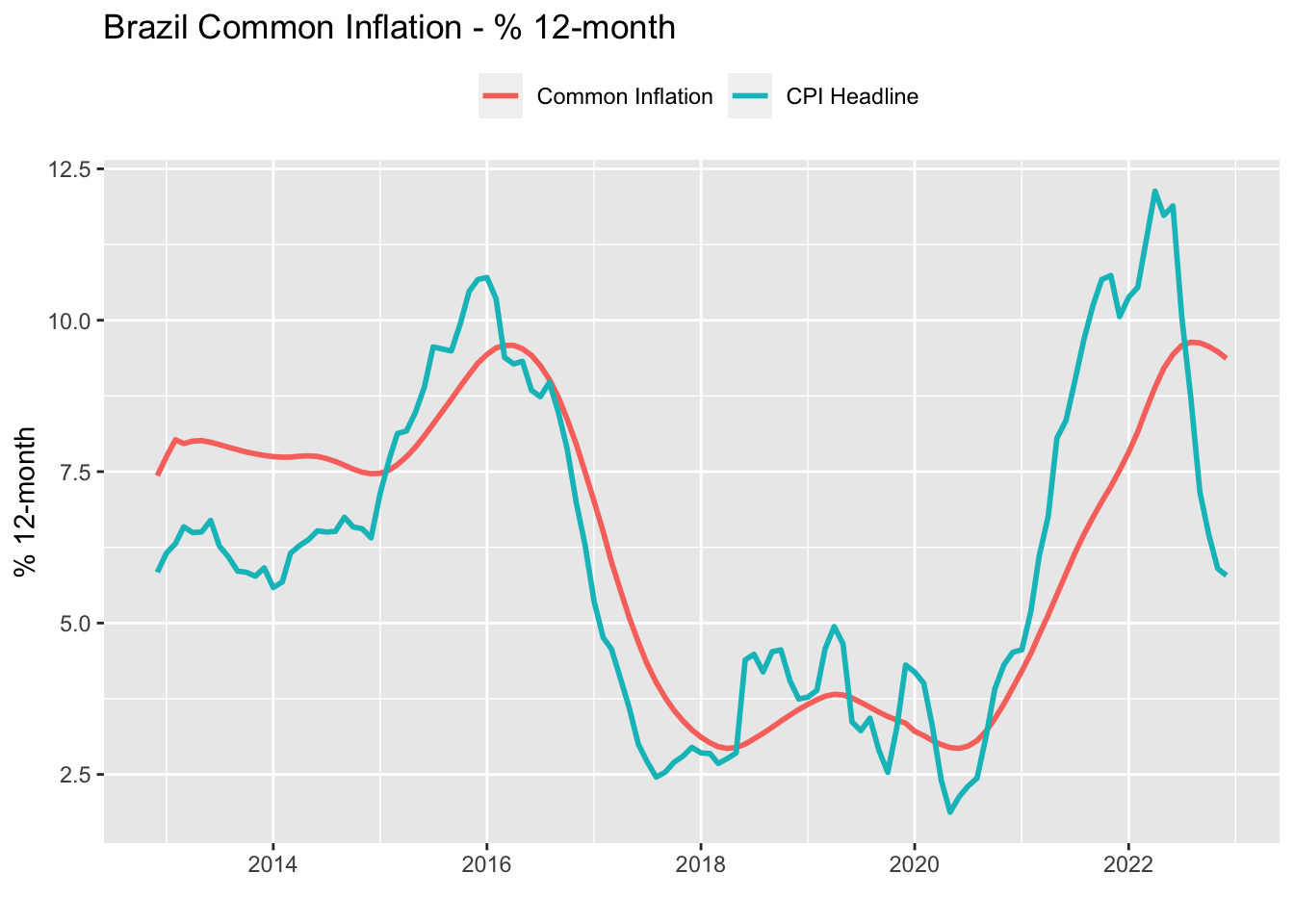

Policymakers and analysts are routinely seeking to characterize short-term fluctuation in prices as either persistent or temporary. This issue is often addressed using core measures that exclude those items that are the most volatile or most subject to supply shocks from the inflation index.

Eli, Flora, and Danilo (2021) argue that core measures are imperfect measures of underlying inflation in that temporary shocks in sectors that were not filtered out from the index may be misunderstood as economy-wide shocks.

The authors propose an alternative measure to deal with this problem. In their words:

“The basic assumption is that each component of the inflation index combines two driving forces. The first is a trend that is common across all components. The second comes from idiosyncratic components that capture one-off changes, sector-specific developments, and measurement errors.”

In fact, this idea is represented by a special class of State-Space models known as Dynamic Factor Model (DFM). In short, DFM allows us to estimate common underlying trends among a relatively large set of time series (see Holmes, Scheuerell, and Ward (2021), chapter 10). Using Eli, Flora, and Danilo (2021) notation, the model has the following structure:

\[ \pi_{it} = \chi_{it} + \xi_{it} \]

\[ \chi_{it} = \lambda_i f_t \] \[ f_t = \sum_i^p b_i f_{t-i} + u_t \ \ \ \ u_t \sim N(0, Q) \] Where \(\pi_{it}\) is the CPI for each subsector \(i\), which is the sum of the common trend, \(\chi_{it}\), and the idiosyncratic component, \(\xi_{it}\). In State-Space language, this is the observation equation and \(\chi_{it}\) is the hidden state (\(x_t\)). However, in this case the hidden state follows an autoregressive process of order \(p\) with \(p\) usually higher than 1. In addition, each subsector will have an individual contribution to the common trend given by \(\lambda_i\) – also known as the factor loading.

14.1 Writing out the DFM as MARSS

We start by writing out the above DFM in MARSS form. The LHS of the observation equation contains now the \(k\) time series corresponding to each observation of the common underlying process, all of them is a function of a single hidden process (the common component) plus a Gaussian innovation term.1

\[ \underbrace{ \begin{bmatrix} y_{1t} \\ y_{2t} \\ y_{3t} \\ \vdots \\ y_{kt} \end{bmatrix} }_{y_t} = \underbrace{ \begin{bmatrix} z_1 \\ z_2 \\ z_3 \\ \vdots \\ z_k \end{bmatrix} }_{Z} \begin{bmatrix} x_t \end{bmatrix} + v_t \sim N \begin{pmatrix} 0, \underbrace{ \begin{bmatrix} \sigma^2_{y_{1t}} & 0 & 0 & \dots & 0 \\ 0 & \sigma^2_{y_{2t}} & 0 & \dots & 0 \\ 0 & 0 & \sigma^2_{y_{3t}} & \dots & 0 \\ \vdots & \vdots & \vdots & \ddots & 0 \\ 0 & 0 & 0 & \dots & \sigma^2_{y_{kt}} \end{bmatrix} }_{R} \end{pmatrix} \] The transition equation, in turn, is a function of its own \(p\) lags. In the MARSS form each lag will be represented by a separate variable, although only the first one, \(x_t\), will have an autoregressive structure. The others are simply treated as identities.

\[ \underbrace{ \begin{bmatrix} x_{t} \\ x_{t-1} \\ x_{t-2} \\ \vdots \\ x_{t-p+1} \\ \end{bmatrix} }_{x_t} = \underbrace{ \begin{bmatrix} b_1 & b_2 & b_3 & \dots & b_p \\ 1 & 0 & 0 & \dots & 0 \\ 0 & 1 & 0 & \dots & 0 \\ \vdots & \vdots & \vdots & \ddots & \vdots \\ 0 & 0 & 0 & \dots & 1 \end{bmatrix} }_{B} \underbrace{ \begin{bmatrix} x_{t-1} \\ x_{t-2} \\ x_{t-3} \\ \vdots \\ x_{t-p} \end{bmatrix} }_{x_{t-1}} + w_t \sim N(0, Q) \]

14.2 Importing data

For this exercise, we’ll use data on the 51 subsectors that make up Brazilian CPI. All these time series are the monthly percentage change accumulated in the last twelve months. This eliminates the need to add seasonal components to the model.Basically, the final output is \(k \times t\) matrix of the \(k\) subsectors time series over \(t\) time steps.

14.3 Estimating the model

Next, we declare the system matrices. Note that by defining the \(R\) matrix as diagonal and unequal, we are assuming that the shocks to prices across the subsectors are independent. This is arguably a very strong assumption, but considering cross-dependence between subsectors would greatly increase the number of parameters to be estimated. Also, we are considering four lags autorregressive terms in prices dynamics.

14.4 Results

After estimating the system, we are ready to compute the common inflation component, \(\chi_{it}\). Basically, \(\chi_{it}\) is the dot product of the \(\lambda_i\) elements (which is the \(Z\) matrix) and \(f_t\) (which is the estimate of the hidden state, \(x_t\)). The aggregate common inflation is obtained as the sum of the contributions of each individual subsector to the headline CPI, using their original weights.

# Compute model's components

ft <- model.em$states[1, ]

names(ft) <- CPI_twelveMonths$date

ft_df <- ft %>%

as.data.frame() %>%

rownames_to_column() %>%

magrittr::set_colnames(c('date', 'ft'))

lambda <- model.em$par$Z %>%

as.data.frame() %>%

tibble::rownames_to_column() %>%

magrittr::set_colnames(c('item', 'lambda'))

chi_it <- lambda %>%

mutate(

chi_it = map(

.x = lambda,

.f = ~ {

df <- .x*ft %>%

as.data.frame()

df <- df %>%

rownames_to_column() %>%

magrittr::set_colnames(c('date', 'chi_it')) %>%

mutate(date = ymd(date))

}

)

) %>%

unnest(chi_it) %>%

left_join(

cpi_df$Weight %>%

rename(c('weight' = 'value'))

) %>%

relocate(date)

# Commpute the common trend

common_trend <- chi_it %>%

group_by(date) %>%

summarise("Common Inflation" = sum(chi_it*weight)/sum(weight)) %>%

ungroup() %>%

left_join(

CPI_twelveMonths %>%

select(date, `CPI Headline` = contains('CPI'))

)common_trend %>%

pivot_longer(-date, names_to = 'var', values_to = 'value') %>%

ggplot(aes(x = date)) +

geom_line(aes(y = value, color = var), lwd = 1) +

theme(legend.position = 'top') +

labs(

title = 'Brazil Common Inflation - % 12-month',

x = '',

y = '% 12-month',

color = ''

)